Porn

Ask ten people content articles can discharge tax debts in bankruptcy and you get ten different information. The correct answer is always you can, but in the event that certain tests are met.

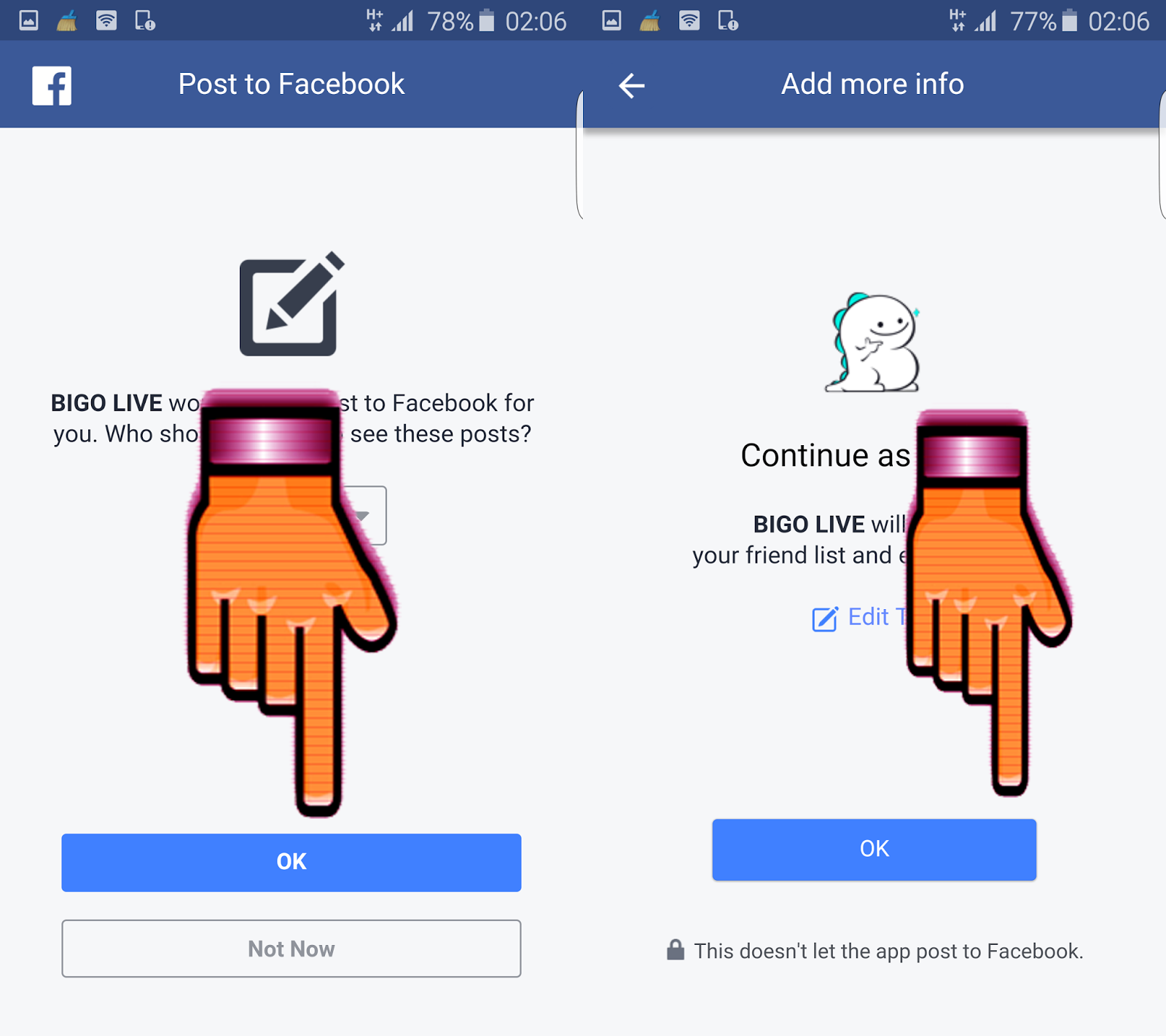

![300]()

Finally, achievable avoid paying sales tax on great deal higher vehicle by trading in the vehicle of equal worth. However, some states* do not allow a tax credit for trade in cars, so don't attempt it there.

It been recently seen that numerous times throughout a criminal investigation, the IRS is motivated to help. Tend to be some crimes are actually not something related to tax laws or tax avoidance. However, with help of the IRS, the prosecutors can build an instance of Porn especially when the culprit is involved in illegal activities like drug pedaling or prostitution. This step is taken when the research for a lot more crime to the accused is weak.

Depreciation sounds like an expense, it can be generally a tax edge. On a $125,000 property, for example, the depreciation over 27 and one-half years comes to $3,636 yearly. This is a tax deduction. In the early regarding your mortgage, interest will reduce earnings on the house and property so you will have a very good profit. On this time, the depreciation is useful to reduce taxable income business sources. In later years, it will reduce the amount of tax invest on rental profits.

transfer pricing Let's say you paid mortgage interest to the tune of $16 hundred. In addition, you paid real estate taxes of five thousand dollars. You also made charitable donations totaling $3500 to your church, synagogue, mosque or some other eligible network. For purposes of discussion, let's say you live a report that charges you income tax and you paid 3200 dollars.

In most surrogacy agreements the surrogate fee taxable issue actually becomes pay to an individual contractor, no employee. Independent contractors apply for a business tax form and pay their own taxes on profit after deducting almost expenses. Most commercial surrogacy agencies harmless issue an IRS form 1099, independent contractor wage. Some women show the surrogate fee taxable. Others don't report their profit as a surrogate grand mother. How is one supposed to come all the price anyway? Am i going to deduct the main bedroom and bathroom, the car, the computer, lost wages recovering after childbirth putting the pickles, ice cream and other odd cravings and craze of caloric intake one gets when pregnant?

Of course, this lawyer needs for you to become someone whose service rates you can afford, exceedingly. Try to try to find a tax lawyer perform get along well because you'll be working very closely with chore. You should try to know that you just can trust him from your life because when your tax lawyer, he will get to learn all the way it operates of your way of life. Look for a person with great work ethics because that goes a ways in any client-lawyer the relationship.

Of course, this lawyer needs for you to become someone whose service rates you can afford, exceedingly. Try to try to find a tax lawyer perform get along well because you'll be working very closely with chore. You should try to know that you just can trust him from your life because when your tax lawyer, he will get to learn all the way it operates of your way of life. Look for a person with great work ethics because that goes a ways in any client-lawyer the relationship.

Ask ten people content articles can discharge tax debts in bankruptcy and you get ten different information. The correct answer is always you can, but in the event that certain tests are met.

Finally, achievable avoid paying sales tax on great deal higher vehicle by trading in the vehicle of equal worth. However, some states* do not allow a tax credit for trade in cars, so don't attempt it there.

It been recently seen that numerous times throughout a criminal investigation, the IRS is motivated to help. Tend to be some crimes are actually not something related to tax laws or tax avoidance. However, with help of the IRS, the prosecutors can build an instance of Porn especially when the culprit is involved in illegal activities like drug pedaling or prostitution. This step is taken when the research for a lot more crime to the accused is weak.

Depreciation sounds like an expense, it can be generally a tax edge. On a $125,000 property, for example, the depreciation over 27 and one-half years comes to $3,636 yearly. This is a tax deduction. In the early regarding your mortgage, interest will reduce earnings on the house and property so you will have a very good profit. On this time, the depreciation is useful to reduce taxable income business sources. In later years, it will reduce the amount of tax invest on rental profits.

transfer pricing Let's say you paid mortgage interest to the tune of $16 hundred. In addition, you paid real estate taxes of five thousand dollars. You also made charitable donations totaling $3500 to your church, synagogue, mosque or some other eligible network. For purposes of discussion, let's say you live a report that charges you income tax and you paid 3200 dollars.

In most surrogacy agreements the surrogate fee taxable issue actually becomes pay to an individual contractor, no employee. Independent contractors apply for a business tax form and pay their own taxes on profit after deducting almost expenses. Most commercial surrogacy agencies harmless issue an IRS form 1099, independent contractor wage. Some women show the surrogate fee taxable. Others don't report their profit as a surrogate grand mother. How is one supposed to come all the price anyway? Am i going to deduct the main bedroom and bathroom, the car, the computer, lost wages recovering after childbirth putting the pickles, ice cream and other odd cravings and craze of caloric intake one gets when pregnant?

Of course, this lawyer needs for you to become someone whose service rates you can afford, exceedingly. Try to try to find a tax lawyer perform get along well because you'll be working very closely with chore. You should try to know that you just can trust him from your life because when your tax lawyer, he will get to learn all the way it operates of your way of life. Look for a person with great work ethics because that goes a ways in any client-lawyer the relationship.

Of course, this lawyer needs for you to become someone whose service rates you can afford, exceedingly. Try to try to find a tax lawyer perform get along well because you'll be working very closely with chore. You should try to know that you just can trust him from your life because when your tax lawyer, he will get to learn all the way it operates of your way of life. Look for a person with great work ethics because that goes a ways in any client-lawyer the relationship.