With Stripe, you'll need to make use of Stripe’s API to configure the hardware together with your POS system or with Stripe Terminal. Stripe, then again, is appropriate for worldwide payments processing, invoicing, and recurring payments. PayPal excels in native apps for pay buttons, subscription processing, invoicing, and casual money acceptance. However, businesses could face challenges discovering integrations on the PayPal page, which primarily focuses on PayPal apps and lacks third-celebration options. Stripe has a searchable database of over seven-hundred companion apps. With over 700 associate apps, Stripe’s app marketplace and developer instruments make it simple to search out and integrate purposes like Salesforce, Harvest, Shopify, QuickBooks, and Eventzilla. It also gives applications for digital promoting, buyer messaging, gift playing cards, discounts, fundraising, and developer applications for marketplaces and enterprise-degree companies. While they both provide good safety instruments and broad integrations, Stripe offers better buyer assist hours and more strong developer instruments.

With Stripe, you'll need to make use of Stripe’s API to configure the hardware together with your POS system or with Stripe Terminal. Stripe, then again, is appropriate for worldwide payments processing, invoicing, and recurring payments. PayPal excels in native apps for pay buttons, subscription processing, invoicing, and casual money acceptance. However, businesses could face challenges discovering integrations on the PayPal page, which primarily focuses on PayPal apps and lacks third-celebration options. Stripe has a searchable database of over seven-hundred companion apps. With over 700 associate apps, Stripe’s app marketplace and developer instruments make it simple to search out and integrate purposes like Salesforce, Harvest, Shopify, QuickBooks, and Eventzilla. It also gives applications for digital promoting, buyer messaging, gift playing cards, discounts, fundraising, and developer applications for marketplaces and enterprise-degree companies. While they both provide good safety instruments and broad integrations, Stripe offers better buyer assist hours and more strong developer instruments.

Conversely, Stripe’s web site signifies restricted availability of microtransaction funds for sure markets, advising users to contact help for particulars. PayPal, however, supplies broader customer support entry and lists 1000's of integrations for varied features. However, if you would like to simply accept in-individual funds, each Stripe and PayPal provide card readers and terminals that can process card funds. When you ship out occasional native invoices and desire echeck funds, PayPal is a user-pleasant choice. Both Stripe and PayPal supply significant security for online funds, however Stripe supplies extra customization, including identity verification. Businesses are responsible for securing customer data collected throughout PayPal transactions and must adjust to all related information-protection laws, including laws akin to GDPR. Systems that processed financial data were not immune and proceed to be susceptible. With Dynamic Micropayment pricing, merchants who've frequent transactions valued at $26.67 or lower get better rates. AOL epayments guru Bob Sandler, who views AOL's neighborhood features as a robust springboard. It gives advanced machine-learning fraud detection options and allows you to customise your acceptable payment risk stage, so that you won’t miss out on gross sales that common fraud monitoring instruments would possibly rule as suspicious and block the transaction.

Conversely, Stripe’s web site signifies restricted availability of microtransaction funds for sure markets, advising users to contact help for particulars. PayPal, however, supplies broader customer support entry and lists 1000's of integrations for varied features. However, if you would like to simply accept in-individual funds, each Stripe and PayPal provide card readers and terminals that can process card funds. When you ship out occasional native invoices and desire echeck funds, PayPal is a user-pleasant choice. Both Stripe and PayPal supply significant security for online funds, however Stripe supplies extra customization, including identity verification. Businesses are responsible for securing customer data collected throughout PayPal transactions and must adjust to all related information-protection laws, including laws akin to GDPR. Systems that processed financial data were not immune and proceed to be susceptible. With Dynamic Micropayment pricing, merchants who've frequent transactions valued at $26.67 or lower get better rates. AOL epayments guru Bob Sandler, who views AOL's neighborhood features as a robust springboard. It gives advanced machine-learning fraud detection options and allows you to customise your acceptable payment risk stage, so that you won’t miss out on gross sales that common fraud monitoring instruments would possibly rule as suspicious and block the transaction.

PayPal supplies vendor safety for an infinite number of transactions, offered each transaction meets eligibility requirements. PayPal has a user-pleasant growth section on its website. PayPal gives better cost choices for your clients, resembling Buy Now, Pay Later, PayPal Credit, and Pay Monthly, encouraging extra sales and growing income. Stripe gives several Buy Now, Pay Later options, like Afterpay. We additionally want to be able to upgrade things like batteries, and somebody needs to invent a battery that is completely happy in chilly weather like our winters. For subscription-based companies, Stripe Billing provides various fashions, customizable with features like coupons and free trials, mechanically producing invoices upon plan selection. Stripe accepts ACH debit and credit payments with fees ranging from $1 to $5 per transaction, whereas PayPal’s echeck fees for invoices are 3.49% plus forty nine cents, capped at $300. Its flat charge plus service charge is barely more cost-effective than gebühren paypal dienstleistungen, which prices $10 for recurring billing and an extra $30 for billing instruments, together with a gateway fee. It supports more currencies and costs less for forex conversion compared to PayPal.

Compare Stripe vs PayPal fees. The dispute fees for both are non-refundable, however this fee is usually lower for Stripe. This ensures that your transactions are coated by PayPal’s Seller Protection coverage. Stripe’s in-person cost processing capabilities are not out-of-the-field solutions, not like PayPal’s. PayPal’s hardware is offered through PayPal Zettle, which is a free level-of-sale (POS) software program with an integrated PayPal checkout. With PayPal, fewer third-party integrations are usually needed, and the platform presents plug-and-play options for straightforward addition of PayPal checkout to websites and on-line marketplaces. Dwolla transactions are sometimes processed inside 2-three business days, because it verifies the funds before permitting the switch. It supports peer-to-peer transactions and gives convenient entry to funds. B2B companies that deal with giant volumes of international transactions would require a more sophisticated fraud detection system to minimize threat and provide maximum vendor safety-and Stripe provides this. PayPal gives fee flexibility, with Venmo and cryptocurrency on its listing. PayPal is more of a traditional enterprise expertise.

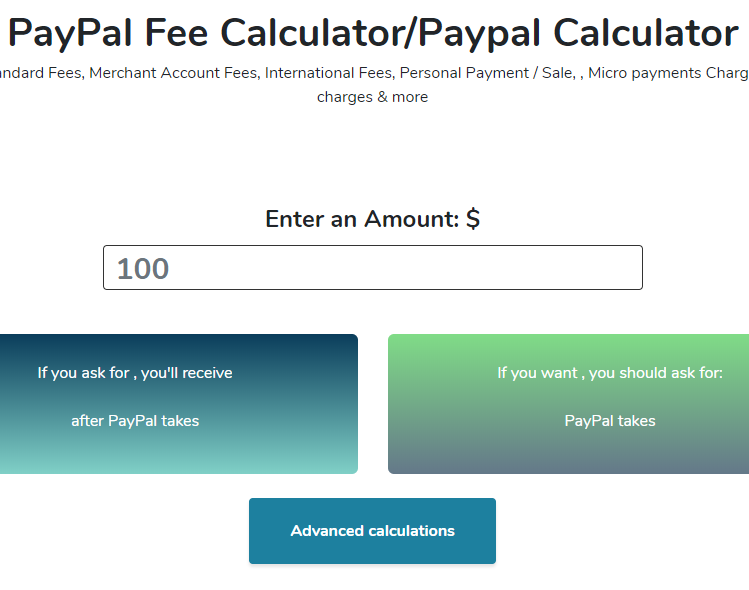

Here's more info regarding Paypal fee calculator check out our own webpage.